Menu

Offers a rapid delivery speed for all orders on a vast selection of products across every major category.

JD.COM Introduction

Before deciding to enter China, research is crucial; Tmall and JD.com (partially backed by Tencent) are the country’s two most prominent players in the e-commerce landscape. So, what are the critical differences between the two platforms? From historic tendencies Tmall for fashion, JD for electronics.

JD.COM Inc. owns JD.COM, otherwise known as Jingdong, formerly called 360buy, China’s top e-commerce platform. It is one of the three major online retailers in China by transaction and volume and is Alibaba TMall’s primary competitor and Pinduoduo

JD.com offers various selections of products in every major category, ranging from electronics, home furnishings & appliances, and apparel to fresh foods, with fast-speed delivery to their Chinese consumers.

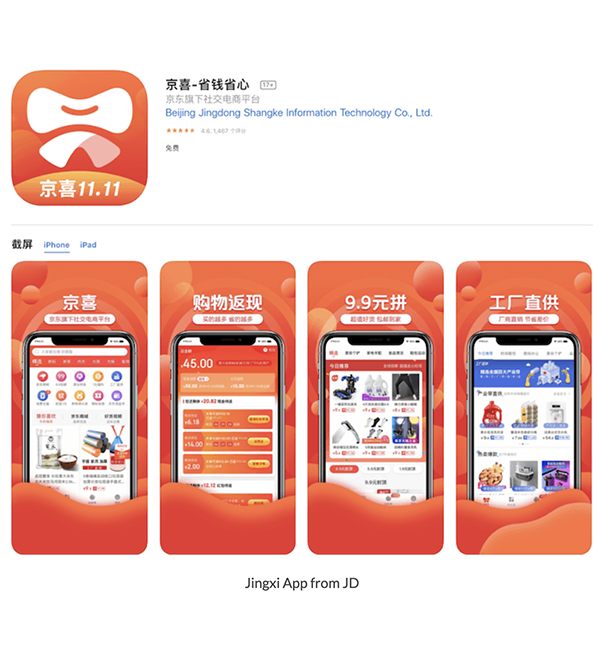

In addition to its online shopping platform JD.com with mobile apps for Android and iOS users, JD.com also launched Jingxi in 2019 to take on its competitor Pinduoduo to cater to China’s lower-tier segments.

By March 2020, JD.com’s daily active mobile users increased by 46% compared to the previous year, 2019.

History

JD.com was founded by Liu Qiangdong, otherwise known as Richard Liu, in the summer of 1998. By 2004, Richard Liu decided to take his company to the worldwide web.

Richard Liu committed his savings of ¥12,000 (US$1,800) in 1998 to lease a small unit in Beijing’s technology hub of Zhongguancun, where he established JD Multimedia, which later became JD.com

The Growth of JD.com

Liu saw the opportunity to utilize the potential of the internet to support his business during the SARS outbreak in 2003 and moved his business JD.com online on June 18, 2004, which is now considered JD’s first 618 promotion.

Although it started as an online optical store, it quickly evolved into selling electronics, mobile phones, computers, and much more. Jingdong Mall changed its domain name to 360buy.com in June of 2007, later changed to JD.com in 2013.

The volume of merchandise continued to increase from ¥32.7 billion in 2011 to ¥125.5 billion (US$20.7 billion) in 2013.

The number of products offered through Jingdong’s online direct sales and marketplace JD.com has grown exponentially from 1.5 million in stock-keeping units (SKUs) of December 2011 to 7.2 million SKUs of December 2012, then to 25.7 million SKUs in December 2013 further to 40.2 million SKUs in December 2014.

The electronics and home appliances category accounted for most of Jingdong total GMV 80.1%, 65.3% and 63,6%, consecutively from 2011 to 2013. Its general merchandise and others accounted for a minor of 19.9%, 34.7%, and 36.4%, respectively.

The total amount of active customer accounts ranged from 12.5 million, 29.3 million, and 47.4 million, which fulfilled approximately 65.9 million, 193.8 million, and 323.3 million orders in 2011, 2012, and 2013.

In 2007, JD.com made a strategic decision to build and operate its nationwide infrastructure. With 86 warehouses in 36 cities across the country with 1,620 delivery stations and 214 pick-up stations across more than 450 cities across China by 2014. By April 2014, their company grew to 24,412 delivery personnel, 11,145 warehouse employees, and 5,832 customer service employees.

JD.com offered same-day deliveries or the day after, and its speedy deliveries leveraged its nationwide infrastructure. In March of 2014, the company provided same-day deliveries in 43 cities and next-day deliveries in 256 cities across China.

Although it started as an online optical store, it quickly evolved into selling electronics, mobile phones, computers, and much more. Jingdong Mall changed its domain name to 360buy.com in June of 2007, later changed to JD.com in 2013.

The volume of merchandise continued to increase from ¥32.7 billion in 2011 to ¥125.5 billion (US$20.7 billion) in 2013.

The number of products offered through Jingdong’s online direct sales and marketplace JD.com has grown exponentially from 1.5 million in stock-keeping units (SKUs) of December 2011 to 7.2 million SKUs of December 2012, then to 25.7 million SKUs in December 2013 further to 40.2 million SKUs in December 2014.

The electronics and home appliances category accounted for most of Jingdong total GMV 80.1%, 65.3% and 63,6%, consecutively from 2011 to 2013. Its general merchandise and others accounted for a minor of 19.9%, 34.7%, and 36.4%, respectively.

The total amount of active customer accounts ranged from 12.5 million, 29.3 million, and 47.4 million, which fulfilled approximately 65.9 million, 193.8 million, and 323.3 million orders in 2011, 2012, and 2013.

In 2007, JD.com made a strategic decision to build and operate its nationwide infrastructure. With 86 warehouses in 36 cities across the country with 1,620 delivery stations and 214 pick-up stations across more than 450 cities across China by 2014. By April 2014, their company grew to 24,412 delivery personnel, 11,145 warehouse employees, and 5,832 customer service employees.

JD.com offered same-day deliveries or the day after, and its speedy deliveries leveraged its nationwide infrastructure. In March of 2014, the company provided same-day deliveries in 43 cities and next-day deliveries in 256 cities across China.

Partnerships and expansion

In 2014, JD.com formed a strategic partnership with Tencent by giving the company exclusive access to Tencent’s WeChat and Mobile QQ. Platforms. Later in 2014, JD became China’s first e-commerce company to list in New York’s NASDAQ stock exchange under ‘JD..’ Towards the middle of 2014, JD Finance launched the country’s biggest crowdfunding platform. By October, Jingdong’s advanced automated logistics center began operation in Shanghai, being Asia’s number 1 warehouse.

By 2016, JD.com announced an alliance with one of the major U.S. retailers Walmart. In the agreement, JD took control of Yihaodian’s marketplace, with Walmart acquiring a 5% stake in the company.

In September of 2019, JD.com officially launched JD.com’s first social e-commerce platform. It was part of a strategy to penetrate the lower-tier cities and to compete with Pinduoduo.

In China, social e-commerce has a much higher conversion rate than traditional e-commerce. Its GMV reached ¥626.85 billion in 2018, with an increase of 255.8%.

With more than 80% of JD.com’s internet shoppers using social e-commerce channels, its fast growth is expected to exceed by ¥2.86 trillion by 2021.

Jingxi is available to all its consumers through multiple channels, including the Jingxi App, the Jingxi Mini Program, and their WeChat first-level entry point. The combination of social media and retail allows Jingxi to provide many products at attractive prices.

With more than 80% of JD.com’s internet shoppers using social e-commerce channels, its fast growth is expected to exceed by ¥2.86 trillion by 2021.

Jingxi is available to all its consumers through multiple channels, including the Jingxi App, the Jingxi Mini Program, and their WeChat first-level entry point. The combination of social media and retail allows Jingxi to provide many products at attractive prices.

Partnership with domestic manufacturers allowed Jingxi to reach more than one hundred industrial clusters, bridging the gap between manufacturers and consumers. Jingxi’s Singles Day Promotion season gained 75% more new users of the lower-tier segments, with more than 55% of its female users.

Liu Qiangong, the CEO of Jingdong, is the second-largest shareholder with more than a 15% stake in the company. Tencent owns 17.8% of its shares, making it the company’s largest shareholder. Additionally, Walmart holds a 9.9% stake in Jingdong, being its third-largest shareholder.

According to online reports, Jingdong comes from the combination of two person’s names: CEO Liu Qiangdong (dong) and his former girlfriend Gong Xiaojing (jing).

JD operates domestically through their e-commerce website JD.com and cross-border e-commerce through JD Worldwide (import). JD Global sells to overseas Chinese consumers, and JoyBuy.com runs the company’s export e-commerce retail.

Jingdong’s primary focus is selling directly to consumers from its platform, whereas Tmall serves as a marketplace for a company to sell to consumers.

Jingdong Worldwide is the company’s cross-border e-commerce platform. They are allowing domestic Chinese consumers to buy overseas products. Kaola and Tmall Global are Jingdong Worldwide’s main competitors.

Contact us

Due to high demand of our services, we offer only a 40-minute free consultancy session

Soi sukhumvit 39 Khlong Toei Nuea, Bangkok 10110

211 Soi Pridi Banomyong 11, Sukhumvit 71 Rd., Khwaeng Phra Khanong Nuea, Watthana, Bangkok 10110